Everyone makes mistakes in life, but financial matters are an area where nobody wants to fall victim. In reality, though, most people are guilty of some very preventable issues.

Here are five of the most common among today’s generation, along with some advice to avoid them.

Buying A Property Too Soon

Becoming a homeowner is an important goal both financially and personally. However, the pressure to buy a home shouldn’t encourage you to swoop too soon. In truth, the price paid for the house isn’t the only cost you’ll encounter. As such, being prepared for agency costs, surveys and the other items is crucial. If you cannot afford them right now, renting a little longer is fine. Apart from saving a bigger down payment, it’s often less stressful.

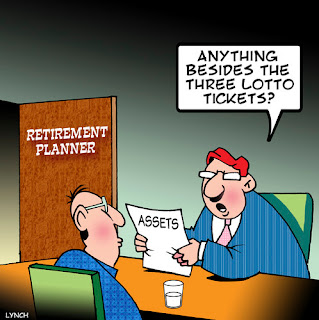

Relying On Standard Retirement Pensions

Retirement is slowly creeping up on you, even if you’re in your twenties. Your standard pension plan will give you a basis, but it won’t be enough to help you live a comfortable life. Investments such as gold IRA funds can increase your wealth significantly. Given that life will inevitably get a lot tougher once you’ve reached retirement age, this extra safety net can make a world of difference. Frankly, assuming that things will be OK without it would be very naïve indeed.

Overlooking The Small Costs

Overheads and expenses are just as pivotal to your financial situation as revenue. Most people appreciate this and will actively make the right moves to save money on major purchases like cars. In truth, though, the savings made on daily transactions is where you can reap the biggest rewards. Whether it’s using coupons for cheaper groceries or tailoring a home TV package to suit your genuine usage doesn’t matter. Wasting money by needlessly overspending will take its toll on finances for many years to come. Prevent this from being an issue, and it’ll pay dividends.

Forgetting Credit Scores

Many people assume financial wealth is solely about bank balances and assets. However, leaving doors open is an equally important factor, which is why your credit history is so vital. A lot of people allow their credit scores to stay low before inevitably falling into greater debt. Repairing yours isn’t an easy job, but it will enhance your future for many years to come. Given that we live in a world where borrowing money is a regular feature, ignoring this is a financial sin.

Not Appreciating Their Worth

Perhaps the worst thing anyone can do, however, is let others take advantage. You’ve invested time to develop skills, earn qualifications and gain experience. As such, you deserve to be paid a suitable salary. Online job boards make it easy to check what people in similar roles command. Talking your way to increased pay is achievable while you may also want to look for opportunities elsewhere. Even if you love your job, payment is the main incentive. Do not forget it.

Avoid those mistakes at all costs, and your financial future will look better than ever. Quite frankly, that’s something that can be appreciated by all.