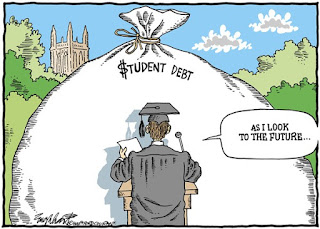

Parents dream of the day when their child will finish school and head off to university to train for their careers. However, the cost of attending colleges these days has begun to skyrocket, and so it’s vital that everyone understands the full implications of that strategy. Sure, everyone wants their kids to get the best job possible when they mature, but most folks have no idea how much that dream is going to cost. In an attempt to set the record straight, this post contains all the information you could need if your little ones plan to go to university during the next couple of years. Make sure you don’t overlook anything, or you might have some nasty surprises.

Course Fees

Depending on the nature of the course the individual wants to take, they will have to pay a lot of money to their chosen college. Sometimes it can take up to five years to achieve a passing grade, and that means most students leave university with thousands of dollars worth of debt according to USA Today. Considering that, it’s vital that all parents start saving for their loved one’s education as early as possible. While it’s possible to get some loans to cover the cost, that just leaves the student with substantial debts before they’ve even started working. For the best savings, be sure to:

- Consider an array of universities

- Start saving early

Student Loans

There are two types of student loan that most people take out. The first one is often to cover the cost of course fees, and so the money goes straight to the college. In most instances, young people don’t have to start making repayments until they find a job. However, the second type of loan is for books and other equipment the individuals might require, and the payments will begin immediately. It’s critical that everyone takes a look at their options when they finally achieve their qualifications. Refinancing deals like those available from refinancestudent.loan and similar online portals could help families to save a small fortune in the long run. That is especially the case if the current debt incurs high rates of interest.

Living Expenses

It’s impossible to ignore the fact that students need to keep a roof over their heads and food in their bellies while dealing with their debt. During a five-year degree course, those costs are going to add up. For that reason, everyone must use some common sense when it comes to paying for those expenses. Students should try to find part-time jobs that will assist in reducing the burden on their parent’s bank balances. On average, estimates suggest that people at a university will spend between $15,000 and $25,000 on living expenses during their three or five years at college. You’ve got to find that money from somewhere!

With a bit of luck, people who read this article carefully should now have a better idea about the real cost of getting an education today. Use the advice to ensure you don’t overlook anything essential and nothing stands in the way of your child’s future. There are scholarships and schemes for young people who don’t come from wealthy backgrounds. Maybe you should take a look at some of those?